estate tax exemption 2022 married couple

As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in. This means that an.

Drafting In Uncertain Times Womble Bond Dickinson

Year two is the following year and is called the tax year.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

. This means that by taking certain legal steps a. Get information on how the estate tax may apply to your taxable estate at your death. Estates of decedents survived by a spouse.

A married couple can give away or leave double. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Ad From Fisher Investments 40 years managing money and helping thousands of families.

On the federal level the estate tax exemption is portable between spouses. During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for. For example a farm couple with a taxable estate of 25 million passes away in 2022.

11700000 in 2021 and 12060000 in 2022. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Above the exemption the.

As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately 6020000 per person or 12040000 for a married couple. The lifetime exemption is the total amount of money that you can give away free of estate tax in life andor death. The federal estate- and gift-tax exemption applies to the total of an individuals taxable gifts made during life and assets left at death.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. This increase means that a married. The property tax exemption program is based on a rolling two-year cycle.

In 2022 the amount each person can give away during lifetime or at death increases from 11700000 to 12060000. For a married couple that comes to a combined exemption of. The program in effect freezes your tax bill at the current amount.

Federal Estate Tax Exemption. For a couple who already maxed out. The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022.

As you contemplate your estate planning or making gifts during the new year here are the numbers that were published for 2022. A married couple has a combined exemption for 2022 of 2412 million 234 million for 2021. The couples heirs may be exempt up to 2412 million from federal estate taxes and.

It is portable between spouses. Ad From Fisher Investments 40 years managing money and helping thousands of families. The federal estate tax exemption is 1170 million in 2021 going up to 1206 million in 2022.

They do so by making big giftstypically in the millions that eat. The IRS has announced that in 2022 the estate and gift tax exemption will be increased to 12060000 per individual up from 117 million in 2021. That way your property taxes remain stable and predictable even if your propertys value or tax rate increases.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Trusts and Estate Tax Rates of 2022. As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021.

By transferring wealth to heirs early the rich can avoid the estate tax. 2022 Exemptions and Exclusions. Key Takeaways The federal estate tax exemption for 2022 is 1206 million.

Year one is the assessment year. For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021. A married couple can give away twice that amount.

The estate tax is assessed at 40 on the biggest estates. This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of. The exclusion amount is for 2022 is 1206.

As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in. Effective January 1 2022. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple can shield 2412 million.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021.

Using Gifting Between Spouses To Maximize Step Up In Basis

End Of Year Tax Planning 2021 Albany Business Review

Using Gifting Between Spouses To Maximize Step Up In Basis

How Canadian Inheritance Tax Laws Work Wowa Ca

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How Do Millionaires And Billionaires Avoid Estate Taxes

Tax Changes After Marriage H R Block

Tax Changes After Marriage H R Block

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Planning Uncle Sam S Nasty Surprise For Non U S Citizen Spouses Cardinal Point Wealth Management

Do I Have To Pay Taxes When I Inherit Money

What Is The Tax Free Gift Limit For 2022

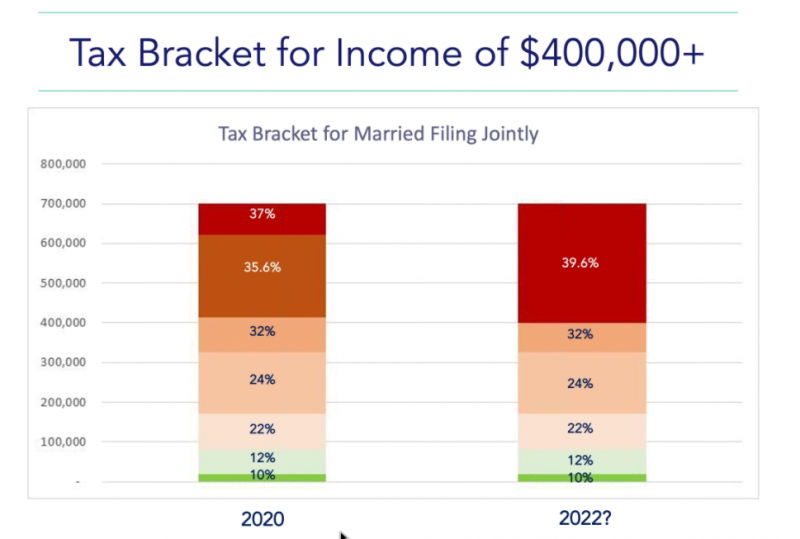

What To Know About Biden S Proposed Tax Policy Elderado Financial

2022 Retirement Plan Contribution Limits 401 K Ira Roth Ira Hsa

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner